With the advent of the industrial era, the number of factories is increasing, the purchase of more and more mechanical equipment, but to extend the use of mechanical equipment, it is necessary to heat it, then with the application and environmental temperature changes, the need for different speed of the cooling fan to meet the heat dissipation needs of the equipment. The normal operation of the cooling fan is crucial to the stability and security of the device. So do you know how to deal with the common faults of cooling fans? The following lists several common faults of DC cooling fans and AC cooling fans and the corresponding solutions:

1.Abnormal sound:

(1) The fan suddenly makes noisy noise

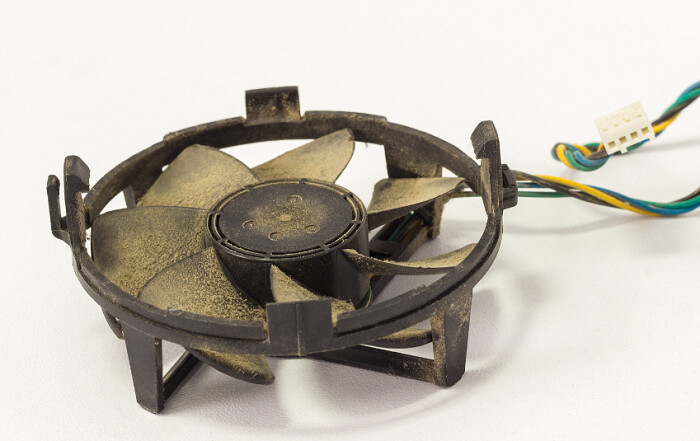

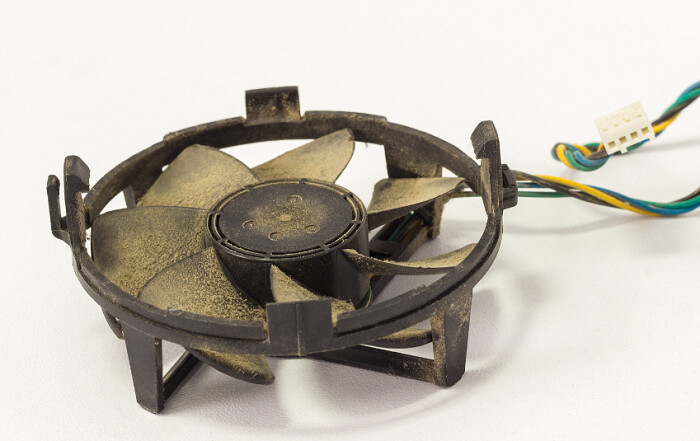

Reason: This is usually because the lubricating oil of the fan is dry, or the fan is dusty.

Measures: As long as the heat pipe radiator and the fan are separated, the fan is cleaned up, and a little lubricating oil can solve the problem.

(2) Abnormal sound When rotating, you can occasionally hear some small collision sound

Cause: The chassis is covered with messy data cables and power cables. The cable ends touch the blades of the DC cooling fan, causing abnormal sound when the fan rotates.

Measures: You can use rubber bands, adhesive paper, etc. to tie the scattered data cable power cord in the chassis to avoid passing over the cooling fan.

2.The cooling fan automatically offsets the position

Reason: The buckle fixing the radiator fails, and the resonance phenomenon caused by operation leads to the displacement of the fan

Measure: Replace the new buckle

3. The rotation is not smooth

Reason: The speed of the cooling fan is slow when it is just started, and it can be restored to normal after a short period of time. Due to the low indoor temperature of the cooling fan, it is easy to lose the effect of the lubricating oil on the rotating bearing.

Measures: Add antifreeze lubricating oil to the cooling fan, and pay attention to the temperature of the surrounding environment when using.

4. Overload protection trigger

Cause: After long-term operation, the cooling fan may be triggered by overload protection. The reason for the protection trigger may be that the power output voltage is too high or the fan load is too large.

Measure: Reduce the load on the fan and ensure that the load is within the rated load range of the fan. If the output voltage of the power supply is too high, replace or repair the power supply.

5. The controller is faulty

Cause: Some advanced AC cooling fans have a circuit controller, if the controller fails, the controller line is damaged, the controller chip is faulty, the fan can not work properly.

Measures: Check whether the controller circuit and chip are damaged, and repair or replace the controller. If it is a line fault, you can rectify the fault by checking that the line is properly connected or testing the line using a multimeter. If the chip is faulty, professional equipment needs to be used to detect and repair the chip.

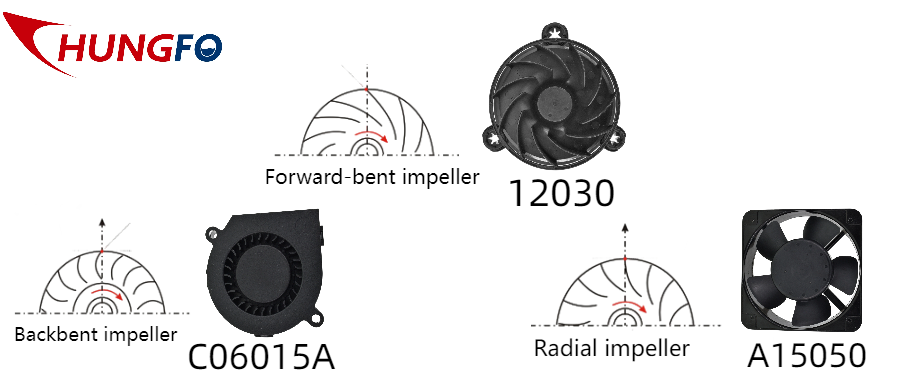

Guangdong Chungfo Electronic Technology Co., Ltd. is dedicated to the equipment cooling needs of various industries, is a professional cooling fan manufacturer. We can provide professional customization of cooling fans according to customer needs. If you have this need, please feel free to contact us.